Theory

Theory

Although we have tried to make the model that we are presenting below as general as possible, it will be developed with Internet services in mind. Due to the large growth in Internet services, the need for valuing these services, and the lack of valuation tools for Internet services, we found it necessary to develop such a valuation tool. When valuing an Internet service it is necessary to bear in mind what is special about the Internet and how this can be used to contribute to the company. To find out what makes the Internet special as an information channel please click here. To be able to fully utilise the possibilities of the Internet it is also a necessary to consider which Internet areas can be used to contribute to the investment’s success. Most companies only use the Internet as an information channel although the usage area of an Internet service can be extended beyond providing information only. In addition to functioning as an information channel the Internet can moreover be used for communication, sales, payment, and distribution. To find out more about the various usage areas, please click here.

As already mentioned above, there are no existing established models for measuring the payoff of an IT investment. The complexity of such an investment involve not only quantitative utilities but also qualitative utilities,which are more complex to measure and hence makes it more difficult to construct a general theory or model that is applicable to IT investments in general. In our literature studies we have found no single model for this purpose.

We have identified two models developed for evaluating different types of soft variables. Their contribution is that they suggest general working procedures that enables calculation of the incomes and costs of an investment of this type. The PENG-model (Dahlgren et al, 1997) was originally developed for evaluating IT investments, for example investments in information systems. The Balloon-model (Enstam et al, 1995) was developed for measuring the effects of an investment in the field of human resources. (We have more information for you to read about these two models if you are interested. Merely click on the links above.)

These models were in convergence with our own ideas and further guided us to find a simple and clear way in

which to present the valuation process. From these two models we have created a model adapted to our purpose, called the GRT model.

The reason for not using the PENG model as it was, considering that it was developed for evaluating IT investments, was that the information about the model that was available to us was too general and did not convey very well how to practically go about to value benefits and utilities. Therefore we felt it necessary to develop a model of our own so we thereby could understand how to use a valuation model in practice. Although the GRT model does not, in this part of the thesis, go into exact detail on how to practically value the benefits and utilities, we find the second part of the thesis, Should Volvo’s Car Buying Service Be Launched in Sweden? A Valuation Made With the GRT Model, being a good example of how to use the model.

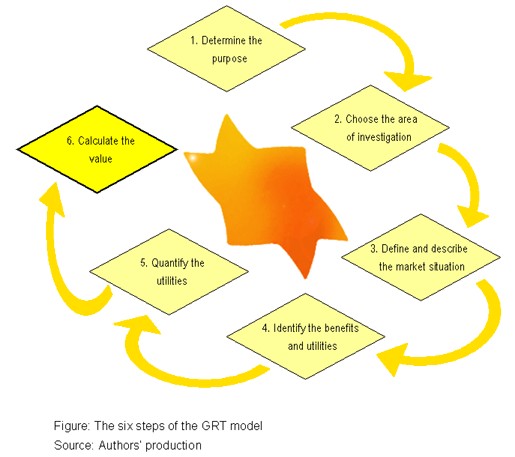

This model is constructed to be used as a model for valuation of IT investments, especially Internet services, whether already existing or merely planned. It may e.g. be used to help deciding whether an IT investment should be carried out or not. The model consists of six steps.

1. Determine the purpose

In the opening stage you define the purpose of your work, what you want to achieve, e.g. answering how much an online customer support service is worth to the company. Furthermore, you identify the problem and make a description of the problem area.

2. Choose the area of investigation

The purpose of this part is to clearly define which parts of the company are to be studied, e.g. an Internet service, and from whose perspective it should be investigated. You also determine which (if any) areas to exclude. In other words, you define the prerequisites under which the study is made.

3. Define and describe the market situation

In this part you describe the market situation, the actors in the business, as well as the parties affected by the investment object. You should also define the framework in which the investment’s consequences will be compared. That is, in order to identify the benefits and utilities of the investment it must be compared with something, e.g. another investment or a competitor’s service. This comparison is also discussed in this part.

4. Identify the benefits and utilities

After enough knowledge gathering on the area of investigation, for instance by reading reliable sources on the subject area and interviewing affected parties and knowledgeable people, you should be able to identify the relevant benefits connected to the investment. In this stage they shall not only be identified but further discussed and given an in depth analysis.

To derive the utilities from the benefits you may consider how cost cuts and increased revenues could be achieved with the identified benefit. You may think in terms of alternative costs, decrease in labour, increase in brand name value, saved money, increased customer loyalty/satisfaction etc. to help identify utilities and to view them in different perspectives to find out which perspective is most relevant for each specific utility. (For a definition of benefits and utilities, click here.)

5. Quantify the utilities

To be able to measure the identified utilities you have to quantify them by coming up with suitable and relevant measures (e.g. saved labour hours or increase in sales) and formulas. This is necessary in order to be able to relate the utilities to figures. Some of the identified utilities may be difficult or even impossible to measure. The utilities that you find economically relevant, yet to complex and/or uncertain to measure, may be considered in a discussion instead.

(The formulas presented in section Direct benefits and utilities for Volvo from launching VolvoNet, in the second part of our thesis, Should Volvo’s Car Buying Service Be Launched in Sweden? A Valuation Made With the GRT Model, are examples of how one may construct formulas to calculate the value of a certain utility.)

6. Calculate the value

For defining the investment’s profitability it is necessary to identify and make an assessment of the costs involved. This may be done by repeating step 4 and 5 for identification and quantification of the various costs.

When the utilities and costs have been quantified, the measures used will be related to an economic value, i.e. an economic value per unit of measurement. When this is done, the theoretical economical value can easily be calculated. The costs can then easily be subtracted from the incomes to get the value of the investment. For this purpose you might want to create a calculation model in a spreadsheet program.

Discussion of the reliability and validity of the model, formulas, and measurements used

In order to make more accurate estimations and calculations on the consequences of an IT investment, a sound

valuation model is necessary to use. In this thesis we have adapted two relevant models, the Balloon and PENG models, to suit the purpose of this thesis. Our model, the GRT model, will assist the work of identifying and quantifying variables and is specifically advantageous for qualitative variables by assisting theoretical analysis and insight into potential benefits and utilities. As a result, the model raises the reliability and accuracy of the estimations of the utilities’ value.

If the investment is yet to be made, we are still talking about estimations. If already made, though, the constructed formulas for calculation of the value of the utilities can be used to calculate the contribution of a certain utility more accurately. The validity will, however, not only be dependent on how the formulas are constructed, it will also be

affected by the accuracy of the input variables. The validity may be raised if results from e.g. surveys and questionnaires are used as input variables instead of estimated numbers.

Pay heed to the risk that the same benefit might be valued in more than one utility. By careful cross-checking while constructing the formulas, measuring, and estimating the values, you can minimise this risk.