Volvo

Direct benefits and utilities for Volvo from launching VolvoNet

Benefits and utilities from entering the Internet market early

VolvoNet enhances the

image as a company

of the future

An early launch of

VolvoNet leads to

publicity

First-movers gain

experience and

knowledge at an early

stage

Benefits and utilities

connected to brand

communication

VolvoNet enables better

control of brand

communication on the

Internet

VolvoNet exposes the

Volvo brand name

effectively

Benefits that render

more effective

information flows and

their utilities

VolvoNet shortens the

introduction phase of

new products

VolvoNet improves

market intelligence

VolvoNet satisfies

customers’ information

needs

Maintaining or

increasing revenue –

benefits and utilities

VolvoNet enables a new

way of generating

revenue

VolvoNet offers

insurance for Volvo cars

Direct benefits and utilities for Volvo from launching VolvoNet

The benefits presented in this section are the benefits that are specific for Volvo and VolvoNet. That is, benefits that will be of direct utility for Volvo and only if they launch a brokering service of their own, such as VolvoNet. For an overview of the benefits, utilities, and their economical contribution, see the Compilation tables for this section. (You may also want to download the Excel-model for valuation of the service. If you do not have Excel, you may download a viewer [here].)

Benefits and utilities from entering the Internet market early

For these benefits to be realised VolvoNet has to be introduced within a near future, before brokering services become commonplace.

VolvoNet enhances the image as a company of the future

With the latest models Volvo has tried to change the way people perceive the brand image. Volvo has developed into being a manufacturer of safe and exciting cars (Illes, 07/12/98) that are promoted as being fun to watch as well as to drive. Previously, Volvo was perceived as a people’s car (at least in Sweden), that was safe but pretty dull.

Their new models are equipped with advanced technology, e.g. the S80 model can be equipped with a navigation

system. This new image of being a modern company is coherent with being one of the first players on the Internet car brokering market. This step can nourish a company’s image of being at the head of technology, not only when it comes to products but also for the company in its entirety. Thus, entering the Internet commerce should manifest the brand as a modern brand and enhance its uniqueness, thereby making it easier to distinguish from other brands.

(Remark: This benefit could also have been placed in the Benefits and utilities connected to brand communication section, but we put it in this section due to the prerequisite of an early launch.)

Utilities

The utilities of this benefit are, first of all, maintained or possibly increased sales.

VolvoNet is a new and attractive service to the customers, which makes use of new Internet technology. The

image as a company of the future, if assumed being attractive to the customers, makes the brand more salient, strengthens it, and increases its value. This enhances the customers’ loyalty, i.e. the Average Customer Value

(ACV) as we have defined it above, will increase. (Lambin 1993, p. 97p and p.138) In addition to increased ACV due to repeated purchases, brand loyalty increases the potential for charging a higher price, a price premium, which also increases the ACV (Evans & Berman, 1988, p. 97 and p. 161). The enhanced attribute might also attract new customers.

These assumptions hold true as long as Volvo’s competitors are not changing their image in the same direction at the same time, as image is relative to those of the competitors. If the competitors’ images are changed in the same way, Volvo will at least not be considered to be a laggard. When considering the value of the utilities of this benefit you should as always compare with the alternative, i.e. the effects if VolvoNet will not be launched.

The other utilities are recruitment cost cuts, personnel turnover cost cuts and a better skilled recruitment base.

The image of a company does not only concern customers but also other parties such as present and future employees. On today’s job market, it’s difficult for the companies to attract a sufficient amount of competent

workers who master the latest technology, especially among the young workers. By achieving a stronger reputation as a company of the future, Volvo will be a more attractive choice for recruits.

Hence, the recruitment base will increase, and it will also be of better quality and value than without this reputation, as the competent workers can better identify with the company and get a stronger feeling of commitment. Here it also follows that the personnel turnover will decrease, ceteris paribus (Robbins, 1996, p. 181). Thereby, a decrease in recruiting costs will follow, both because of decreased personnel turnover and the greater number of applicants to choose from for new assignments.

For estimating the value of the utilities above, we use a formula that solely estimates the value connected to the benefit of enhancing the image of being a company of the future, i.e. not values connected to other brand image benefits, which are discussed and valued in other sections.

The value of the utilities may be estimated with the following formulas:

[ delta ACV × (Cn + delta C) + delta C × (ACVn + delta ACV) – (delta ACV × delta C) ] + [ (RCn-RCy) + (RVy – RVn) + TCTn-TCTy ]

where

y = VolvoNet is decided to be launched

n = VolvoNet is decided not to be launched.

C = The number of customers that buy a Volvo.

Delta C = The change in number of Customers that buy a Volvo due to the utility, if the service is launched

ACV = Average Customer Value, calculated as the average value of all generated cash-flows in the future, discounted to present value, for every Volvo car customer.

Delta ACV = Change in Average Customer Value due to the utility, if the service is launched.

RC = Recruitment Costs = Average Recruitment Costs × number of new employees.

RV = Recruitment Value, i.e. the discounted value of new employees.

TCT = Total Costs for personnel Turnover, i.e. the cost of replacing workers who leave the organisation. (According to Robbins (1996, p. 27), a conservative estimate of the cost is about SEK 120.000 per employee.)

Example:

Let us say that the effects of the benefit above for the first year will be as follows; we estimate the average customer value (ACV) to increase from SEK 150,000 to SEK 150,020 due to the benefit and that the total number of customers will increase from 20,000 to 20,050 if VolvoNet is launched. Let us also say that the average cost for recruiting a new employee is decreased from SEK 50,000 to SEK 49,500 and that Volvo Cars in Sweden needs to employ 100 new employees. (We do not consider the number of extra employees necessary if launching VolvoNet here, as those costs, as well as other costs will be estimated by Volvo.) We also say that the difference between the discounted value of the new employees that year, compared to the value of those that would have been recruited

without VolvoNet, will be SEK 500,000. Finally, we assume that personnel turnover decrease from 50 to 45 people and that each employee leaving the company would cost an extra (120,000 – 49,500 =) SEK 70,500.

Using our formulas would give us the following calculations:

20 × (20,000 + 50) + 50 × (150,000 + 20) – (20 × 50) = SEK 7,901,000

and

((50,000 – 49,500) × 100) + 500,000 + (5× 70,500) = SEK 1,303,500

An early launch of VolvoNet leads to publicity

In Sweden new car brokering over the Internet is still in its cradle and rather unknown to the majority of the public. Thus, an early entry in the market by one of the most well-known car manufacturers in Sweden can attract news media and create a lot of low cost PR through publicity. The publicity created by an early launch can in combination with promotion efforts succeed in creating considerable awareness of the new service as well as word-of-mouth. As publicity is presented by a third party it is also perceived as unbiased and thereby possesses more credibility than pure advertising (Sanz de la Tajada, 1996, p. 270). Furthermore, publicity is a form of news and thereby attracts more attention than advertising does (Evans & Berman, 1988, p. 321), thus publicity has a greater impact upon

the market than ordinary marketing efforts.

Another major advantage of publicity is its low cost relative to achieving the same result with other marketing efforts. Zoltan Illes (07/12/98) estimates that a launch of VolvoNet would generate publicity worth more than the cost of the PR campaign.

PR can also stimulate the sales force’s and dealers’ enthusiasm for VolvoNet (Kotler, 1991, p. 643). Since prior experience of using the Internet as a sales channel in Sweden has not been very successful this could be of great help.

There will probably be several car manufacturers that enter the Internet market in 1999, but being one of the first-movers promotes Volvos image of being a modern company as well as it promotes VolvoNet.

Utility

Volkswagen, who was the first manufacturer to launch a service in Sweden similar to VolvoNet, received a lot of publicity in connection with the launch of their service, in fact a little too much as it resulted in an overload and temporary breakdown of their computer system. We are convinced that Volvo, with its strong position on the market and brand awareness would receive considerable publicity in connection with an early launch. Creating the same awareness with a late launch with more manufacturer web sites on the Swedish market would certainly be costly.

Comparing public relations with promotion is difficult; objectives, techniques, and possibilities are different. Publicity has a higher credibility and gets more attention but it is also more difficult to measure the results of a PR campaign than measuring other forms of promotion (Sanz de la Tajada, 1996, p. 269). In the Volvo case this should be

possible to do, since awareness of the product is non-existent before its launch. Although not all the visits to the site can be accredited to the PR campaign it will certainly have made a big contribution. This is the direct result of the campaign but it also creates an awareness of the brand to a larger audience.

To estimate the value of the publicity as a result of an early launch we calculate the alternative cost for promotion. The basis for our calculation is that the promotion should have the same effect as the PR in terms of reaching the same population and result in the same number of visits on VolvoNet. For this purpose we use the objective-and-task method (Kotler, 1991, p. 582).

We assume that the PR campaign reaches 2 million people i.e. 25 percent of the Swedish population and that 20,000 or 1 percent of these visited VolvoNet in connection with the launch. We further assume that in order to

reach a visiting rate of 1 percent, equal to the effect of publicity achieved by the launch of VolvoNet, the population

needs to be exposed to 30 advertising exposures. Now you must calculate the number of Gross Rating Points (GRP) that would need to be purchased. A Gross Rating Point is defined as one exposure to 1 percent of the population reached by the medium. We know that we want to calculate the alternative cost for the PR campaign, which we assumed reached 25 percent of the Swedish population and to achieve a 1 percent visiting rate we need 30 exposures per 1 percent of the population, which gives 25 × 30 = 750 Gross Rating Points. Now we only need to know the average cost of one Gross Rating Point, which represents the cost for one exposure to 1 percent of the population reached by the medium. The cost for reaching 1 GRP through the Swedish commercial television channel TV4 is about SEK 12,500 – 17,000 at prime time hours (18.00 – 23.00) (Lönegren, 16/12/98). The total

alternative cost using this channel would then, in this example, be 750 × 15,000 = SEK 11,250,000. Using TV4 simplifies the example, as the reach of the channel is equal to the total Swedish population.

Share of total population reached

by the publicity = x (%)

Share of x that visits VolvoNet = y (%)

Number of exposures needed to reach y % visiting rate = z

Cost of an average Gross Rating Point = a

Formula for calculating the alternative cost of a PR campaign [(x × z) × a],

where (x × z) is the number of GRP needed to reach (y) percent.

(Kotler, 1991, p. 356).

By subtracting the cost of the PR campaign you will get the net value of the campaign.

First-movers gain experience and knowledge at an early stage

Being the first to enter a specific market gives, in addition to the utilities already mentioned, the entering company several advantages as well as disadvantages in the competition with other companies. These implications are investigated in literature such as Lieberman and Montgomery (1988). They are mostly concerned with innovations and new products, although we consider it to be comparable to entering the new market of the Internet with mature

products like cars. Thus, several of the advantages and disadvantages of being one of the pioneers of car brokering over the Internet should be the same as for launching a completely new product on the market.

First movers attract customers who learn and get accustomed to their way of doing business, they become loyal to the company and its service. Late entrants have to come up with convincing arguments for customers to give up

something familiar for something unfamiliar. Furthermore, a service like VolvoNet, that is one of the first services made available to the customers on the market, attracts a disproportionate large amount of attention from customers and the general public. Hence, later entrants have to have a disproportionate superior service or disproportionate

amount/quality of advertising to reach the same attention as the first-mover. Pioneers that can attract a significant amount of customers in the initial stage can also influence which attributes or functions that are important and thereby setting the standards. (Lieberman & Montgomery, 1988, p. 46) The advantages given above makes it more and more expensive to regain market shares lost to first-movers. (Hagel & Armstrong, 1997, p. 7)

Since there is always a risk that customers become loyal to a specific brokering service instead of a specific car make (Washington, 26/01/98), it is important that Volvo does not lag behind actors such as Autobytel.se and Bilweb. If the customers become loyal to a third party broker service where many different makes are represented without any preferences there is a risk that the consumer might just as well buy a e.g. BMW as a Volvo. Therefore it is important to start attracting customers to VolvoNet early.

Being a first mover does not only bring advantages. Being one of the first involves breaking new ground, which includes a period of trial and error before the right way is found. This period can be very costly, especially when being the only pioneer, since development costs are not being split between companies. These investments and experiences can later on be used for free by late entrants who watch and learn from others mistakes. Hence, being a first-mover implies high risks and high costs compared to being a late entrant. (Lieberman & Montgomery, 1988, p. 47). If the pioneer does not correct its mistakes, the customers will let them down for a better service.

Utility

A first entrant on the market automatically receives a 100 percent market share. The customers learn to interact with the company through its new medium and the pioneer learns to profit from the new medium’s possibilities and how to interact with the market. Studies have shown that pioneers often develop sustainable competitive advantages often related to higher market shares (Kotler, 1991). As other companies enter the market the market is split between the actors.

As of January 1999 the Swedish Internet market for auto brokering of new cars is divided between Autobytel.se, Bilweb and Volkswagen. If Volvo as a well-known brand and market leader in Sweden enters the Internet market we

believe they can take advantage of synergy effects. That is, as an additional broker of Volvo cars enters the market the total market share of Volvo cars should increase (incl. Autobytel (ABT) and Bilweb) compared to other makes. In other words VolvoNet does not only steal visitors from ABT and Bilweb but also attracts new Volvo customers to the Internet market.

Being one of the first manufacturers in the new market Volvo can avoid the switching cost of attracting customers that are already tied up with existing competitors. As described above this cost can be substantial since customers are already accustomed to how other services function.

We consider the return on investment from this utility too complex to estimate, mainly due to the unpredictable outcome of the benefit and its connected disadvantages, why we do not provide a formula for this utility.

Benefits and utilities connected to brand communication

These benefits are using, facilitating, increasing, or controlling the brand communication. Thus, the benefits are not only concerned with improving the brand communication.

VolvoNet enables better control of brand communication on the Internet

A well-known brand is one of the most valuable assets a company can have. Although an extreme example, the brand name Coca-Cola was in 1995 estimated to a financial value of $39 billion (Kapferer, 1997, p.22).

Most things that can be bought today, whether it is a product or a service, contains more and more abstract values compared to concrete values. The higher the perceived risk a purchase implies to the customer the more important is the brand (Kapferer, 1997, p. 26p). The better impression a customer gets when buying a product from a particular brand, the higher the possibility that the customer repurchases the same brand next time without evaluating the other brands on the market. The brand works as an identifier of the product, i.e. it communicates the

product’s “personality”. By communicating with the customer, the perceived risk of the purchase is decreased and the customer becomes more loyal to that particular brand. (Assael, 1995, p.253).

Major investments, like cars, cause customers to do a more thorough research before buying, than they would with other products. Since the differences in quality, design etc. are diminishing on the car market today (Lööv, 24/11/98), the brand can still make a difference as an identifier of the car’s specific image (Kapferer, 1997, p. 93p). As mentioned above, the brand is used as an aid, or a shortcut, in the buying decision process. Many of Volvo’s customers in Sweden are repeated Volvo buyers, although there is a tendency today towards less brand loyalty

than there used to be (Lööv, 24/11/98).

This implies that the control of your own brand is too important to be ignored and left in the hands of outsiders, nor should the control be spread between several actors. Volvo experienced this when individual dealers in the U.S. put up their own web sites and communicated their own message with the brand. As an example, a Volvo dealer in Texas, U.S.A., had a web site which showed a picture of himself in a stetson hat and cowboy boots, calling himself Mr. Volvo (Ceder, 11/11/98)! In Sweden, Bilia’s dealers have their own web sites and communicate the brand in their own way. By having a brokering service of their own, Volvo can better control brand communication, content, message, and design regarding their presence on the Internet, and do so within the company. Thereby, Volvo makes it possible to adapt the marketing strategy of the Internet to the overall marketing strategy. This also makes it

possible to affect customers’ preferences in specific directions towards specific models or versions. The web site can actively be used as a marketing tool at the same time as it is a brokering service. As an example, on the introduction pages on VolvoNet, colour pictures of the expensive models, at the moment C70 and S80, are exposed. On web sites like Autobytel.se and Bilweb the different models of every make is merely objectively presented on a list with no preferences for any specific brand or model.

Utilities

There is in fact only one utility(increased or maintained sales) connected to this benefit, but for two different reasons.

First Volvo can, as mentioned above, influence the customer to buy a more expensive car than she intended to. In other words, it is possible to increase the Average Customer Value. Advertising more expensive cars on the site of course affects the visitor, as do commercials on television. We argue that customers exposed to online advertising

directed towards more expensive car models available, certainly are influenced by this in their buying process.

One could argue that the trend of increased price sensitivity in the car business that exists today would mean that customers cannot be influenced to buy a more expensive car than they intended to buy from the beginning. So

may be to some extent, but the modern higher priced Volvo cars have been profiled as exclusive cars with attributes that the wealthy customers could appreciate. In other words, if Volvo succeeds in communicating that there is value added (in aspects of e.g. high safety and good image), some customers will be willing to pay for it. Selling a larger share of more expensive cars mean better margins, thus an increased Average Customer Value.

Secondly, compared to if VolvoNet is not being launched, and hence losing control of how Volvo’s brand is communicated on the web, customer loyalty will increase due to a stronger and more uniform brand communication. If there would be contradictions in the brand image, a disintegration of the brand image in the customers’ minds would follow. Thus, both the Average Customer Value and the number of customers might increase due to the control of the brand communication.

Hence, the formula:

[delta ACV × (Cn + delta C) + delta C × (ACVn + delta ACV) – (delta ACV × delta C)] – due to selling a larger share of more expensive cars by advertising on VolvoNet

+

[delta ACV × (Cn + delta C) + delta C × (ACVn + delta ACV) – (delta ACV × delta C)] – due to maintained or increased customer loyalty,

where

n = VolvoNet is decided not to be launched.

C = The number of customers that buy a Volvo.

Delta C = The change in number of Customers that buy a Volvo due to the utility, if the service is launched

ACV = Average Customer Value, calculated as the average value of all generated cash-flows in the future, discounted to present value, for every Volvo car customer.

Delta ACV = Change in Average Customer Value due to the utility, if the service is launched.

For example, if ACV is 150,000 without VolvoNet and increases by SEK 30 due to sales of higher priced cars and an extra SEK 20 due to coherent brand communication, the total increase in ACV is 50. We further assume that the number of customers increases from 20,000 to 20,010, also due to coherent brand communication, give us the following calculation:

50 × (20,000 + 10) + 10 × (150,000 + 50) – (50 × 10) = SEK 2,500,500

VolvoNet exposes the Volvo brand name effectively

When a visitor surfs on the VolvoNet site she is constantly exposed to the Volvo brand name. At the Belgian VolvoNet the average time for surfing is a couple of minutes according to statistics from Framtidsfabriken. This

means a constant brand exposure of several minutes per visitor. Considering that an Internet surfer is active in her information search (Jakobsson, 1995, p. 31p), compared to a viewer of TV commercials that is more passive, the exposure and influence on the Internet can be assumed to be of higher quality than for TV exposure. There should also be a comparison in cost of the exposure. The marginal cost for an extra unit of exposure time is next to zero

for VolvoNet but for a TV commercial it is considerable.

By attracting potential customers to a site where the focus is all on the Volvo cars increases the probability for the customer to request an offer for a Volvo before another make. The customer’s attention is not split up between different makes. Albeit a visit on the web site does not necessarily result in a purchase, the power of the resulting

word-of-mouth might.

Utility

These exposures affects the customer the same way other efficient marketing does, hence increases the number of customers purchasing a car and/or the ACV.

[delta ACV × (Cn + delta C) + delta C × (ACVn + delta ACV) – (delta ACV × delta C)]

where

n = VolvoNet is decided not to be launched.

C = The number of customers that buy a Volvo.

Delta C = The change in number of Customers that buy a Volvo due to the utility, if the service is launched

ACV = Average Customer Value, calculated as the average value of all generated cash-flows in the future, discounted to present value, for every Volvo car customer.

Delta ACV = Change in Average Customer Value due to the utility, if the service is launched.

Benefits that render more effective information flows and their utilities

These benefits increase, improve, and speed up the information flows between Volvo and the dealers. The information flows to and from customers are also speeded up and have a higher frequency.

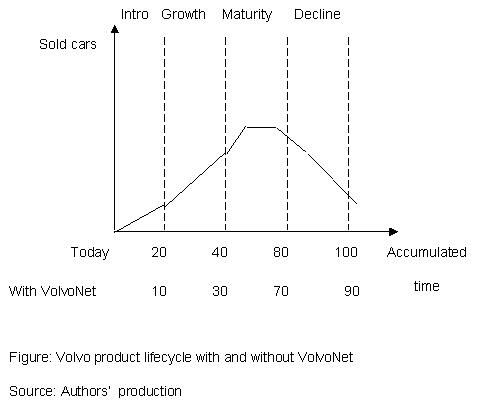

VolvoNet shortens the introduction phase of new products

According to the product life cycles (PLC) theory, the introductory phase of a product is characterised by low profitability due to low sales combined with high costs for launching the product, like advertising and promotion (Lambin, 1993, 214 pp). With a distinct trend towards shorter lifecycles for car models (Illes, 07/12/98) it is necessary to start earning money from the products at an earlier stage. Thus, it is necessary to shorten the introduction phase to be able to harvest the revenues from the more profitable phases of the PLC, such as growth

and maturity (Assael, 1995, p. 671p). In other words, it becomes more and more essential to reach high volume fast.

To reach high volumes fast two factors are important; how early a product or service is adopted and the speed at which the adoption spreads on the market. Adoption occurs when consumers form a positive attitude towards a

product. The spread of adoption of a product is called diffusion. Diffusion is as important as the adoption in order to reach high sales volumes early. There is no use having a very fast adoption process if there is no diffusion. (Assael, 1995, p. 683 and p. 687p)

The speed of adoption and diffusion can be affected by e.g. the type of product in question and the level of risk connected to a purchase. The use of an Internet brokering service as a tool for introducing new products can affect a third factor, the speed of communication, which in turn affects the other two factors, i.e. adoption and diffusion.

Two of the general benefits of the Internet are its geographical independence, i.e. information is spread just as easily to every corner of the world, and secondly, the speed at which the information can be spread to people. (See The Internet as an information channel for details). By taking advantage of these benefits you can reach the market fast and effective, and thereby shorten the time of the introduction phase. The faster the communication process, the sooner people learn about the new product and can hence start purchasing and adopting the product. Once the

adoption has begun, so can the diffusion.

Utility

With the Internet’s capability of fast communication, VolvoNet will increase the speed at which new product information is spread on the market. What makes this a VolvoNet specific utility and not a general Internet utility is its function as a brokering service. An ordinary web site could also be used for introducing new products, the difference is the intentions of the visitors. The average visitor of VolvoNet can be assumed to have reached further in her buying process than the average visitor of an ordinary web site. This implies that using VolvoNet for introducing new Volvo models will have greater impact than introducing them on other web sites where the average visitor is not about to buy a car. This will in turn shorten the introduction phase (see figure below). Consequently, shortening the introductory phase will reduce the time before the product reaches its breakeven point. In other words, Volvo can experience a faster return on investment (ROI), as the maturity phase is reached at an earlier time, which is closely related to profitability.

A shorter introduction phase also leads to a shorter product lifecycle if market shares remain at the same level. By shortening the introduction phase the entire product life cycle is shifted to the left in the figure below. This implies that the later phases; growth, maturity, and decline are reached and ended earlier than if the introduction phase would stay the same. Although it could be argued that as long as the competitors do not offer the same service, you might gain market shares by being able to present the products shortly after their release. When competitors launch similar services to VolvoNet the competitive advantage disappears, but the service still prevents Volvo from losing market shares for the same reason.

The company ends up with the same money, provided the same market share, but with VolvoNet the ROI is faster and they can then use the money for alternative purposes.

The present value (PLCP) for the earlier profit from car sales in Sweden (E) for each period of time (P) with an interest rate for the time P (R) can be calculated with the formula

PLCPP+ t = EP × (1/(1+R/100)P) – EP + t × (1/(1+R/100)P + t),

where

t = the shift in PLC in days divided by the period of estimations of earnings in days.

We assume that the shift in the PLC is one week and that the first day of sales due to the shift in PLC is tomorrow. Normally there would not be any sales until later, e.g. on the eighth day in our example.

If we want to estimate the sales per day and we assume an earlier profit of SEK 50,000 for the eighth day (E8). We also assume a PLC shift of one week, which implicates that t = 7/1 = 7. We also calculate on an interest rate of 10.8 % per year, which means with estimation per day that we must calculate with an interest rate of 10.8/360 (= 0.03 %) for one day. Hence, the present value for the eight day of earlier sales (PV8), which are realised on the first day of sales, due to the shift in the PLC is

PV8 = SEK 50,000 × (1/(1+0.03/100)1+7) = SEK 49,880,16, in round figures SEK 49,880.

Due to the shift in the PLC, this income comes one week earlier. Hence, the contributions of

earlier profits from the eighth day (PLCP8) equals PV8 – PV1, where the present value of getting profit tomorrow (PV1)= SEK 50,000 × (1/(1+0.03/100)1) = SEK 49,985,

hence PLCP8 = PV1 – PV8 = SEK 49,985 – SEK 49,880 = SEK 105.

To calculate the total contribution of earlier profits (PLCPtot) during the PLC, we calculate the contribution for each period of time until the end of the life cycle n, hence

Source: Authors’ production

VolvoNet improves market intelligence

It is possible to extract different types of information from visits on the site. Using electronic forms, is one way of gathering customer data. This technique can be used to collect data about customer preferences and demographics. Other techniques can extract data about how a person surfs, how long she stays, on which site a person was

before visiting VolvoNet, and where she goes afterwards, how a typical buyer behaves on the site etc.; and this can be logged without visitors noticing it.

By using electronic forms that customers can fill in, Volvo can avoid using personnel and ordinary mail to distribute the forms. The electronic forms are distributed to the customer at the same time she visits the page of the form. Electronic forms are also much faster since the reply is only a matter of how fast a customer can fill in a form;

the time for sending the form is close to zero. The time for distributing ordinary forms usually takes up a considerable part of the research time. Another advantage is that the data is constantly collected, the form is always available. Customers fill out forms when they order a brochure, a test-drive, a request etc.. When using ordinary channels, data gathering is limited to a specific period of time, i.e. you are not continuously sending out forms but rather restricting it to a certain time period. There is also a natural selection of people filling in the form; a visitor of VolvoNet can be assumed to have at least some interest in Volvo cars. There is no need for a selection process to finding out e.g. who to interview. Though this can also be a drawback, unless you use good incitements to

make customers fill in forms, there is a risk of receiving a biased selection of customers. Are there only very loyal Volvo customers that fill in the forms or is it people who are not serious about the form? Thus, the quality of the data in the forms becomes more uncertain when using electronic gathering.

Using a technique such as cookies to learn the behaviour of visitors is more useful than asking the visitors how they interact with VolvoNet. For example, instead of asking how long a visitor stays at a specific site you can study

what really happens. In other words, whereas interviews give information about what already has happened, cookies give data about what happens at the moment, hence gives more recent data. Data gathered this way is not only done at a lower cost compared to traditional methods, but is also of higher quality. It may even be that some data cannot be retrieved any other way, seeing that there are no acceptable alternative ways of gathering the data.

The data extracted in different ways from customers online can be refined to information for improvement of the VolvoNet site and in addition give information to the sales- marketing- and R&D department as well as to the dealers. For example, the information gathered can later on be used in marketing. As you get to know your customers better and better you can customise marketing messages for small groups of individuals.

Utility

Information with higher quality and information that is difficult to gather can be collected, by for instance the use of cookies. Visitors’ behaviour can be observed precisely and objectively as opposed to interviewing visitors about e.g. how they behave when surfing, which is always somewhat biased. Another benefit with information collected through electronic forms is that information is collected continuously while traditional collection has chronological interruptions, which decrease the quality of the information.

Information with higher quality can be used for more effective marketing since it can give a more accurate representation of the market (at least for the Internet customer segment). Marketers are provided with an extra tool for predicting and monitoring the market environment. (Evans & Berman, 1988, p. 48p).

Hence the formula:

Result of SEK x invested in marketing based upon high quality VolvoNet information – result of SEK x invested in marketing based on information without VolvoNet = value of increased ACV and/or increased number of customers buying a car.

VolvoNet satisfies customers’ information needs

If all necessary information for a car purchase can be found on the same web site there will be no need for Internet customers to look elsewhere for more information. The more complete information that can be provided on VolvoNet, the less need does the customer have for other sources of information since it is more convenient to find all information at the same place. The amount of information provided thereby becomes competitive means. In order to prevent car shoppers from choosing third party dealers, VolvoNet has to provide something no one else does or can. Thereby VolvoNet conveys extra value to the customers. Instead of breadth they need to provide depth, third party brokering services provide limited information on an extensive list of makes whereas VolvoNet provide extensive information on one make only. The information they provide is extensive and thorough. Customers

should not be able to find the same amount of information about Volvo cars on any other web site. Manufacturer web sites must be specialists as opposed to third party brokers that are more of generalists.

Volvo presents the different models they are offering, their technical specifications, accessory options, prices, pictures etc.. As far as Volvo is concerned, VolvoNet provides both in depth and broad information, thus, this kind of information should not have to be published in brochures and given over the phone to the same extent as without

VolvoNet. There will for a foreseeable time be customers that want information that is not provided on VolvoNet and customers that want to be able to print out information or order a brochure for more convenient reading, as well as customers that do not use VolvoNet for a variety of reasons. We are supposed to have entered the computer age but most people have not totally adopted the paper-free society and still need some information presented on paper. For example, reading a lot of text on most of the monitors of today can be exhausting for the eyes compared to a

paper print.

Utilities

As have been implied above, the utility from providing the customer with comprehensive information is cost-cuts. This utility is twofold; first, the need for phone service is decreased if the information demand is already satisfied. Thereby, the phone services demand for staffing is decreased and Volvo can decrease labour costs. Secondly, also under the condition that the information demand is satisfied, a decreased demand for brochures decreases the cost of printing and distributing them. This gives us the following formulas:

CPD = CNB × (UPC + UDC)

CPD = Changed Printing and Distribution costs for sent brochures.

CNB = Change in the Number of Brochures.

UPC = Unit printing cost.

UDC = Unit distribution cost.

CLC = LC/h × Ah/PC × CNP

CLC = Change in Labour Costs

LC/h = Labour cost/hour.

Ah/PC = Average number of hours/Phone Call.

CNP = Change in Number of Phone calls.

Assumption: The customers information need is satisfied on VolvoNet

Regarding the assumption, it should be noticed that in spite of numerous aids to decrease the use of paper the fact remains that there is not a simple relation between ’paper saving’ aids and the amount of paper used.

Maintaining or increasing revenue – benefits and utilities

With several actors on the Internet, Volvo risks lose sales. By launching VolvoNet, losses can be reduced and a new source of revenue is available.

VolvoNet enables a new way of generating revenue

VolvoNet is a service providing utilities for both dealers and customers. Thus, it should be possible to charge one or both of them for the service. Charging the customers could be very risky, as it would certainly make many customers use other sites that are free of charge. That leaves charging the dealers, which is already in practise by Volvo’s competitors. For both ABT and Bilweb, the dealer fee is one of the main sources of income. They are, or will be, charging their dealers a membership fee, a fee per mediated request, or possibly a combination of the two. (There are more information for you to read about the competitors if you are interested. Merely click on the links above.) Eneqvist (25/11/98) expects Volvo to be charging a fee for VolvoNet, although not a higher fee than those of the competitors. Charging a fee seems rather logical since other similar services are charging the dealers a fee and the dealers we have been in contact with seem to be willing to pay a fee for this kind of service.

According to Zoltan Illes (07/12/98), Volvo has not yet decided whether they will charge a low monthly fixed cost or if the service should be free of charge. The higher the number of customers mediated through VolvoNet the more

utility there will be for the dealers. Investigations from the U.S. show that the advertising cost for selling cars on the

Internet is considerably lower than for selling through traditional channels (OECD). This implies that, in the future dealers will be able to cut down on marketing efforts in traditional channels as (and if) the Internet becomes a successful brokering channel for cars. This, as well as an increased number of customers, could motivate Volvo to charge a (higher) fixed fee or charging a fee per mediated customers.

Utility

The market situation allows Volvo to charge a fee from its dealers. Not only because the competitors are doing so but also because they provide a service which gives a value added to the dealers. (To read more about benefits for the dealers, click here.) As dealers spend substantial amounts of money each month on advertising, in especially newspapers, a small fee for a competitive Internet service would not be considered a big investment. With 150 connected dealers and a monthly fee of SEK 1,000 the income would be SEK 1,800,000 (150 dealers × 12 months × SEK 1,000) and at least help cover some of the costs of the investment.

[Fixed monthly fee × 12 × Number of connected dealers + fee per mediated request × requests mediated]

Although most dealers may be willing to pay a fee to join VolvoNet, there may also be a point in charging a very low fee or even no fee at all. With no fee charged very small extra efforts are needed for the dealers to start up car brokering on the Internet. This should lead to a very high connection rate of Volvo dealers, including Bilia dealers.

VolvoNet offers insurance for Volvo cars

Volvo is offering their own car insurance, Volvia (Illes, 07/12/98). This service is also offered through VolvoNet. If Volvo will not launch VolvoNet it will have negative implications for Volvo’s sales of insurance. As of today, approximately 50 percent of new Volvo customers buy a Volvia insurance (Lööv, 24/11/98).

Even though a customer would choose to buy a Volvo when going to a third party dealer, Volvo might lose the opportunity to sell their own insurance since Autobytel.se and Bilweb offer competitive car insurance from other insurance companies.

Neither VolvoNet, nor Autobytel.se, or Bilweb will reach customers who prefer to insure their cars through their ordinary insurance company. The problem from Volvo’s point of view with not having a brokering service, is those of the Volvo car buyers that may want to buy a car specific insurance together with the car over the Internet. If the insurance offered by Autobytel.se and Bilweb are competitive they will capture some of these insurance customers.

The situation will most likely be different if Volvo has a brokering service of their own. These customers will then at

least be potential buyers of Volvia’s insurance, seeing that some of them will use VolvoNet instead of third party brokers when buying a car.

Utility

The utility from offering insurance on VolvoNet is that it will take up the competition with other car specific Internet insurance offered by third party brokers, and if not increasing, at least maintaining the market shares of insurance sales for Volvia. Thus, compared with not offering the insurance on VolvoNet, the insurance sales will increase. VolvoNet must offer their own insurance if they want to reach customers that want to buy a car specific insurance.

VolvoNet prevents that some insurance customers buy their insurance through third party brokers.

To calculate the increased profit due to insurance brokering on VolvoNet we start out with the number of customers that will buy a Volvo on the Internet. This number is multiplied with the share of customers, who also will buy their car insurance on the Internet. This is multiplied by the share of customers who buy their Volvo through VolvoNet. This is finally multiplied by the average insurance margin noted in SEK. This gives us the following formula:

EP = VCI × IIS% × SVN × AIM

EP = Extra profit from Volvia insurance

VCI = Number of Volvo customers on the Internet

IIS% = Share of car shoppers on the Internet that also buys a car specific insurance on the Internet

SVN = Share of those that buy their Volvo through VolvoNet

AIM = Average Insurance Margin (SEK)

Assumption: Customers that buy their insurance on the Internet buys it at the same site as the car

To give an example we assume the following numbers:

- 5,000 customers buy their Volvo on the Internet

- 20 percent of the car buyers on the Internet also buy a car specific insurance over the Internet

- 50 percent of those who buy their Volvo over the Internet use VolvoNet

- Average Insurance Margin is SEK 500

This gives us the following calculation:

5,000 × 0.20 × 0.50 × 500 = SEK 250,000

This gives us the extra profit on insurance sales due to offering Volvia insurance on VolvoNet.

Sales of accessories due to better options

Internet shoppers are said to be more rational than ordinary shoppers are. They search for, and have access to, more information and can thereby make more rational decisions. As we mention in VolvoNet satisfies customers’ information needs, by being better informed the dealer’s influence on the customers may decrease. A shift in the balance of power in the buying process is about to occur. (Hagel & Armstrong, 1997, p.17)

With more rational customers, it might be more difficult to sell accessories such as luxury optional packages. These packages contain several different accessories and the total price for a optional package range from BFR 50,000 to BFR 110,000 (approximately SEK 11,000 to SEK 26,000) on the Belgian version of VolvoNet. Such accessories appeal more to the feelings and desired image of the customer than their rational mind. Thus, the sales of luxury

accessories would decrease.

Under these circumstances, VolvoNet has the potential of counterbalancing this effect by offering a wider range of packages, and also by offering more of optional single accessories. For example, if a choosy customer cannot find a light metal wheel that she really likes she will probably buy the default wheel that comes with the standard car.

But if there is a wide range of wheels, the probability to find one that she really likes is higher, and thereby the probability for buying the other wheels becomes higher. The availability and increased range of single accessories might also improve sales. This might also happen if Volvo provide pictures showing the accessories, as well as providing more information about them available with a click.

If the customer is reluctant to buy accessories from the beginning she should become even more reluctant if she finds out that accessories can only be bought in expensive packages. Thus, if the customer can buy the accessories

she wants individually she does not have to spend the same amount of money, compared to if she would have to buy an optional package. Although it is already possible to buy individual accessories at third party brokers the selection is rather restricted, VolvoNet offers a wide selection of individual accessories and the customer can thereby more accurately select the desired ones.

Another solution for diminishing a presumed decrease in sales of accessories along with the purchase might be to send the dealer information about what accessories and packages the customer showed interest for on VolvoNet while surfing. See section VolvoNet improves market intelligence for information on how this may be possible. This would give the dealer a second chance to sell additional accessories and the probability would be even greater if information about the benefits with the accessories has not been requested by, or provided to, the customer.

Utility

As we mentioned in the VolvoNet section (in definition and description of the market situation), the service provided by VolvoNet, as opposed to third party brokers, give the customers the opportunity to fully choose between all accessory packages available. It also lets the customers be in control of choosing just one or two of the accessories contained in a specific package, thus making the customer more satisfied.

If the customers behave as predicted by Zoltan Illes (07/12/98) and Hagel & Armstrong (see above), and purchase less accessories, they might at least become more satisfied by being able to get a lower price on the car than they expected to. Increased customer satisfaction would mean increased loyalty and cash flows after the purchase, thus diminishing a decreased average customer value.

From the discussion above, we could use a formula for calculating the positive or negative effects of the benefit. Estimation of the values will be easier if and when VolvoNet has been in service for some time.

[delta ACV × (Cn + delta C) + delta C × (ACVn + delta ACV) – (delta ACV × delta C)]

where

n = VolvoNet is decided not to be launched.

C = The number of customers that buy a Volvo.

Delta C = The change in number of Customers that buy a Volvo due to the utility, if the service is launched

ACV = Average Customer Value, calculated as the average value of all generated cash-flows in the future, discounted to present value, for every Volvo car customer.

Delta ACV = Change in Average Customer Value due to the utility, if the service is launched.

Compilation tables for this section

To make the presented benefits and utilities with incident formulas easier to grasp we have below compiled them in a table. The table is divided into two parts as to separate formulas that can not be added to each other. The formulas based on ACV and number of customers take into account future sales due to repurchases (see defintion of Average Customer Value for details). The results of these formulas can not simply be added to, for example, publicity due to an early launch, which can be assumed to only have effect in the launching stage of VolvoNet.

(Download the Excel-model for valuation of the service. If you do not have Excel, you may download a viewer [here].)

| Benefits | Utilities | Formulas | Definition |

| VolvoNet enhances the image as a company of the future |

Increases the employee value and decreases recruitment costs and employee turnover |

[ (RCn-RCy) + (RVy – RVn ) + TCTn-TCTy ] |

RC = Recruitment Costs = Average Recruitment Costs × number of new employees. RV = Recruitment Value, i.e. the discounted value of new employees. TCT = Total Costs for personnel Turnover, i.e. the cost of replacing workers who leave the organisation. |

| An early launch of VolvoNet leads to publicity |

Saves marketing costs |

[ (x × z) × a ] |

x (%) = Share of total population reached by the publicity y (%) = Share of x that visits VolvoNet z = Number of exposures needed to reach y % visiting rate a = Cost of an average Gross Rating Point (x × z) is the number of GRP needed to reach (y) percent. |

| First-movers gain experience and knowledge at an early stage |

Easier to take market shares due to less switching costs to attract customers |

N/A | N/A |

| VolvoNet shortens the introduction phase of new products |

Gives a faster Return On Investment |

[ PLCPtot = S(p=1 to n) for ( EP × (1/(1 + R/100)P ) – EP + t × (1/(1 + R/100) P+ t) ) ] |

PLCP = present value of earlier profits E = earlier profits from car sales P = period number of estimation R = interest rate for the time period P t = the shift in PLC in days divided by the period length for estimations of earnings in days n = number of test periods |

| VolvoNet improves market intelligence |

Improves the impact of marketing efforts | [ Result of SEK x invested in marketing based upon high quality VolvoNet information – result of SEK x invested in marketing based on information without VolvoNet = value of increased ACV and/or increased number of customers buying a car. ] |

N/A |

| VolvoNet satisfies customers’ information needs |

Change the demand for telephone services |

[ CLC = LC/h × Ah/PC × CNP ] |

LC/h = Labour cost/hour. Ah/PC = Average number of hours/Phone Call. CNP = Change in Number of Phone calls. CLC = Change in Labour Costs |

| As above | Change the demand for brochures | [ CPD = CNB × (UPC + UDC) ] | UPC = Unit printing cost. UDC = Unit distribution cost. CNB = Change in the Number of Brochures. CPD = Changed Printing and Distribution costs for sent brochures. |

| VolvoNet enables a new way of generating revenue |

Increases revenue due to member fees |

[ Fixed monthly fee × 12 × Number of connected dealers + fee per mediated request × requests mediated ] |

N/A |

| VolvoNet offers insurance for Volvo cars |

Maintained or increased sales of insurance |

[ EP = VCI × IIS% × SVN × AIM ] |

VCI = Number of Volvo customers on the Internet IIS% = Share of car shoppers on the Internet that also buys a car specific insurance on the Internet SVN = Share of those that buy their Volvo through VolvoNet AIM = Average Insurance Margin (SEK) EP = Extra profit from Volvia insurance |

Source: Authors’ production

Long term benefits and utilities that take future sales to customers into account and that thereby cannot simply be added to the benefits and utilities above.

Since these utilities are calculated with the same formula one can use the same initial value for two of the variables namely these:

ACVn which is the initial value of the Average Customer Value if VolvoNet is not launched and Cn which is the initial value of the number of customer if VolvoNet is not launched.

| Benefits | Utilities | Formulas | Definitions |

| VolvoNet enhances the image as a company of the future |

Increases ACV and the number of customers |

[ delta ACV × ( Cn + delta C) + delta C × (ACVn + delta ACV) – ( delta ACV × delta C) ] |

n = VolvoNet is decided not to be launched. C = The number of customers that buy a Volvo. Delta C = The change in number of Customers that buy a Volvo due to the utility, if the service is launched ACV = calculated as the average value of all generated cash-flows in the future, discounted to present value, for every Volvo car customer. Delta ACV = Change in Average Customer Value due to the utility, if the service is launched. |

| VolvoNet enables better control of brand communication on the Internet |

Increases ACV and the number of customers |

See above |

See above |

| VolvoNet exposes the Volvo brand name effectively |

Increases the ACV and the number of customers |

See above |

See above |

| Sales of accessories due to better options |

Increases the ACV |

See above |

See above |

Source: Authors’ production